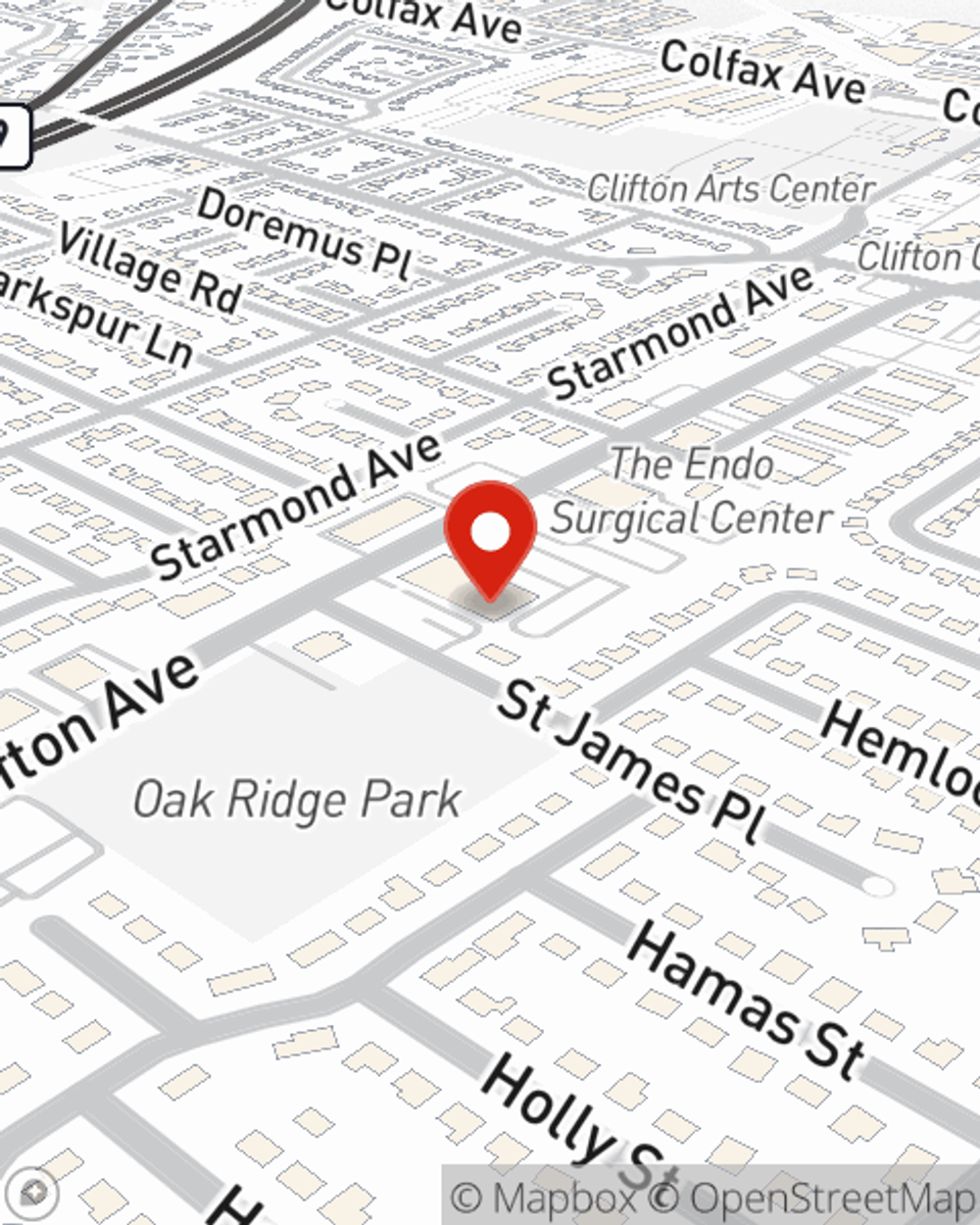

Life Insurance in and around Clifton

Coverage for your loved ones' sake

What are you waiting for?

Would you like to create a personalized life quote?

- Bloomfield

- Montclair

- Nutley

- Belleville

- Lyndhurst

- Lodi

- Little Falls

- Woodland Park

- Totowa

- Caldwell

- West Caldwell

- Paterson

- Passaic

- Newark

- Cedar Grove

- Wayne

- Glen Ridge

- North Caldwell

- Pompton Lakes

- Lincoln Park

- Haledon

- Hackensack

- Garfield

- Rutherford

Check Out Life Insurance Options With State Farm

One of the greatest ways you can protect the ones you hold dear is by taking the steps to be prepared. As uneasy as pondering this may make you feel, it's a great idea to make sure you have life insurance to prepare for the unexpected.

Coverage for your loved ones' sake

What are you waiting for?

Their Future Is Safe With State Farm

Having the right life insurance coverage can help loss be a bit less overwhelming for your partner and allow time to grieve. It can also help cover matters like grocery bills, future savings and home repair costs.

Don’t let the unexpected about your future keep you up at night. Visit State Farm Agent Thomas Tobin today and find out how you can rest easy with State Farm life insurance.

Have More Questions About Life Insurance?

Call Thomas at (973) 779-4248 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

Thomas Tobin

State Farm® Insurance AgentSimple Insights®

Three main misconceptions people have about life insurance

Three main misconceptions people have about life insurance

Three Main Misconceptions People Have About Life Insurance - State Farm®

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.